Improved administration of resources by accumulating decentralized information and distributing it to system individuals. Bridges are advanced and have been targeted by hackers prior to now, so at all times verify that a service is audited and widely used. Multi-chain DEX aggregators, corresponding to 1inch or LI.FI, are main https://www.xcritical.com/ the greatest way in bringing DeFi’s range to all users. Get crypto market analysis and curated information delivered right to your inbox each week.

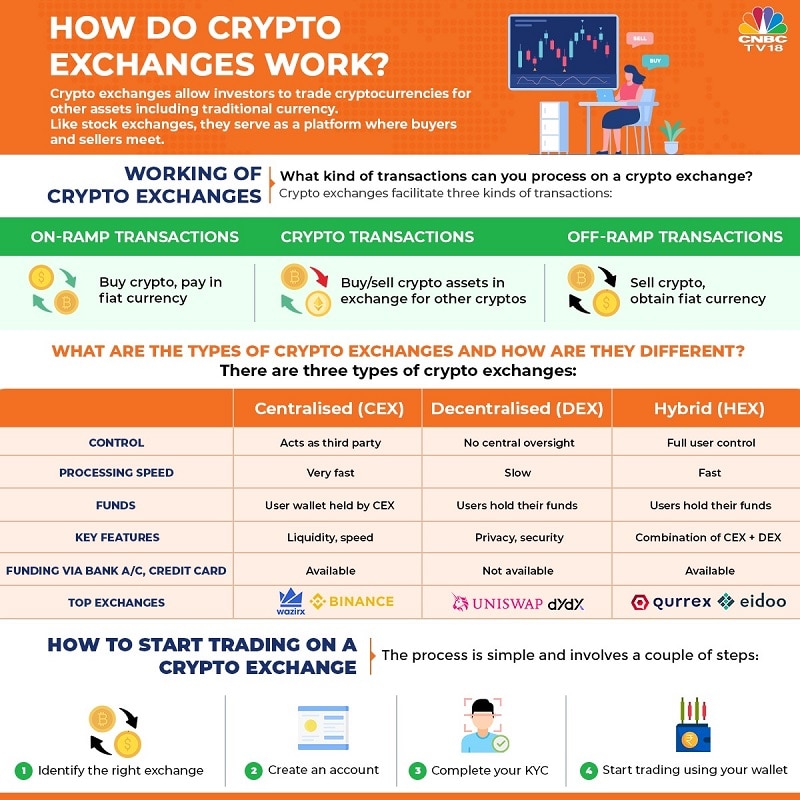

Hybrid Exchanges mix options from both centralised and decentralised models. These platforms provide https://radio.cut.ac.zw/how-a-lot-money-do-you-actually-want-to-begin-day/ the consumer expertise of CEXs while offering some custody benefits of DEXs. The restrict order permits a trader to pinpoint the exact worth at which he wants to buy or sell.

Subsequently, the matching engine begins to look for the following closest seller that could help to finish the order. Market instability can complicate withdrawals or disrupt buying and selling methods, particularly during periods of maximum volatility. Trade operations could experience delays or limitations when processing high volumes of transactions throughout unstable market situations. Trading interfaces show real-time market information including value charts, order books, and transaction histories in customisable layouts. You can modify these displays to match your most well-liked buying and selling style whether you’re executing fast market orders or analysing detailed technical indicators. Encryption know-how safeguards your private data and transaction data during transfers between your gadget and the trade servers.

How To Choose An Exchange To Purchase Crypto?

For inexperienced crypto customers, the most secure exchanges are those with intuitive person interfaces and easy-to-follow safety protocols that make it hard for them to put their assets at risk accidentally. Cryptocurrency wallets are applications that permit you to securely store, ship, and obtain cryptocurrencies. The Tangem Pockets requires an NFC-enabled smartphone to use the app for managing crypto. It’s possible that Binance may be forced to withdraw this product sooner or later. Recently, the SEC has focused exchanges like Kraken that have provided cryptocurrency staking to their prospects (more on this later). Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax legal professional specializing in digital assets.

This Is How You Use Volume When Trading Crypto

Since each trade calculates the value based mostly on its own buying and selling volume, an exchange with extra customers is in all probability going to provide more market-relevant costs. This is why there are often slight discrepancies in the price of cryptocurrencies amongst different exchanges. Crypto exchanges, centralized and decentralized, are the gateways to buying, selling, and buying and selling cryptocurrencies. Choosing the best exchange is decided by your experience stage, security wants, and desired options. For newbies, user-friendly interfaces and academic resources are necessary. Security-conscious traders ought to prioritize established exchanges with robust options like cold storage and multi-signature wallets.

These platforms typically implement order books managed by central entities whilst executing trades by way of good contracts, creating a middle floor between the 2 traditional fashions. Binance, Coinbase, and Kraken, for instance, are CEXs, they usually care for consumer accounts, manage order books, and provide custody for buyer assets. DEXs supply many types of tokens to trade since assets don’t have to be individually vetted by a centralized authority. Moreover, they offer enhanced automation, anonymity and privacy in comparability with centralized exchanges. This could change over time as regulation matures, requiring users to establish themselves to the trade and participate in cryptocurrency exchange correct reporting for tax and anti-money laundering functions.

In Accordance to Statista, over 420 million people globally owned cryptocurrencies by 2025, and this quantity continues to climb as exchanges make crypto buying and selling accessible, quick, and safe. The most popular method for monetizing centralised exchanges is thru charging commissions on their platform. For every trade that occurs on the change, a set fee price, as low as zero.1% may be charged. Due to elevated competition, new exchanges battle with thin liquidity during consolidated markets, and thus go for charging itemizing charges for coins to be listed on their change. This, in addition to facilitating Initial Exchange Choices (IEO’s) acts as an alternative revenue stream for exchanges. Lastly, popular exchanges opt to concern native change tokens, providing charge incentives to holders on their exchanges in an try and foster a native ecosystem.

- Sure, crypto exchanges operating in the UK should acquire authorisation from the Financial Conduct Authority (FCA).

- They are usually user-friendly, and they don’t hold traders’ assets; as an alternative, assets are saved in private wallets, thereby eliminating the risk of loss because of security breaches.

- You ought to think about whether you understand how CFDs work and whether or not you presumably can afford to take the high danger of losing your money.

For occasion, Coinbase earned over $3.1 billion in transaction revenue in 2024, demonstrating the large scale of crypto trading economics. This happens inside seconds as a outcome of exchange’s off-chain ledger system, which records trades internally before last blockchain settlement. For starters, imagine that you’re a beginner investor, and want to purchase your very first Bitcoin. You resolve to go with a well-liked change platform, such because the aforementioned Binance. They also employ multi-signature cold wallets, which require a quantity of Peer-to-peer authorizations before funds may be moved, preventing any single point of failure or unauthorized entry. Keep up to date with our latest change evaluations, promotions, how-to guides and academic articles on Bitcoin, cryptocurrency & more.

How To Decide On A Crypto Exchange

Furthermore, some of these exchanges support margin trading and allow users to trade between cryptocurrencies and conventional fiat currencies, allowing for flexible funding administration. They are managed by a central authority or firm that oversees transactions and holds users’ funds, performing as intermediaries between buyers and sellers. As such, CEXs are topic to intense regulatory oversight, requiring users to complete Know Your Buyer (KYC) and Anti-Money Laundering (AML) checks. Liquidity refers to how easily an asset could be purchased or bought available in the market with out affecting its value, which is central to the cryptocurrency exchange definition. Excessive liquidity is fascinating because it allows traders to execute giant orders shortly and at steady costs.

If you consider buying Bitcoin or different digital currencies, crypto exchanges are your launchpad. These online platforms, like stock exchanges, allow you to buy, sell, and trade cryptocurrencies like Ethereum or Tether. Accessible through mobile apps or desktops, they offer a user-friendly experience for novices and seasoned traders. Beyond fundamental crypto trading, some exchanges provide superior options like margin buying and selling or futures contracts.

Recent Comments